EPIC NEWS

Stay informed with up to date industry related news.

Latest News

EPIC represents US Dream Homes Realty for Folsom location

Epic Real Estate Advisors, Inc, one of area’s fastest growing companies and leading provider of integrated real estate services, today announced that it has completed a lease with US Dream Homes Realty at 1720 Prairie City Road in Folsom, CA in the Folsom Corners office park. The leased space is comprised of 2,250 square feet in an office building offering a multitude of amenities near the intersection of Iron Point Road and Prairie City Road. Epic’s Heath Charamuga and Scott Laeber were approached by Terri Cicchetti of US Dream Homes Realty with an immediate need to source a new home for the #1 ranked Folsom residential brokerage firm. Terri Cecchetti became a top agent by understanding that everyone’s needs are different and she helps each family accommodating their individual requirements. “This new location will provide a “high-profile” well positioned office for one of the top residential brokerages in our region. As a commercial real estate brokerage firm, ourselves, we were honored to represent such a respected residential firm.” Epic’s Charamuga states.

GPR Ventures sells four-property portfolio

Longtime investors in the Sacramento region industrial market have teamed up to buy a four-property portfolio of parks on or near the Highway 50 corridor. Catalyst Real Estate in San Francisco and SIII Investments in Sacramento announced this week their purchase of the four parks, with more than 400,000 square feet between them. The two entities paid $51 million for the four parks, or about $126.70 a square foot. GPR Ventures, based in Campbell, appears to be the seller in the deal.

The four properties are: Franklin Business Park, a 158,468-square-foot industrial park. Gold River Business Park, a five-building, 66,970-square-foot park. Skyway Business Park, a three-building, 151,936-square-foot park. Sunrise Gold Business Park, a single-building, 24,624-square-foot property. Occupancy is about 92% across the properties, with more than 140 tenants in an average suite size of about 2,800 square fee.

EPIC completes lease in El Dorado Hills

Epic Real Estate Advisors, Inc, one of area’s fastest growing companies and leading provider of integrated real estate services, today announced that it has completed a lease with Terrence V. Bowels Business Services at 4970 Windplay Drive in El Dorado Hills, CA. The leased space is comprised of 1,129 square feet move-in ready space with vista views. The business services group selected Grant Deary of Epic Real Estate Advisors to handle their relocation out of a larger space in El Dorado Hills. Grant will also list their old space on the market for sale or lease. “It can be difficult to find small office space in El Dorado Hills that will allow a tenant to move in immediately, but that was exactly what we were able to do.” states Epic’s Grant Deary. Terrence Bowels Business Services provided business advice and accounting for a multitude of area business and individuals. The new office, run by Sarah Beasley, will consolidate their office, but allow the company to work much more efficiently, offering their clientele a location in the same area as previously.

EPIC represents anyCOMM on lease in El Dorado Hills

Epic Real Estate Advisors, Inc, one of area’s fastest growing companies and leading provider of integrated real estate services, today announced that it has completed a lease with anyCOMM Holdings Corp at 4970 Robert J Mathews Parkway in El Dorado Hills, CA. When the industrial condominium was recently vacated by Ralco Medical Components, who just relocated out of the United States, its ownership tapped Epic’s Grant Deary to handle backfilling the unit. Grant, who has been making “recent waves”, in the El Dorado Hills marketplace, was able to secure a new tenant in short order. The newly backfilled building is comprised of 1,941 square feet with an additional 946 square feet mezzanine and was provided to the tenant in move-in ready condition. The tenant, anyCOMM, also represented by Deary, is the leading provider of real-time wildfire monitoring in California. anyCOMM provides a way to modernize a utility company power infrastructure. They offer an extensive installation of highly innovative and comprehensive safety and fire detection technology along power transmission lines and within select substations. Epic’s Deary states “Due to our direct knowledge of area tenants and meeting with many of them to discuss future needs, we were able to backfill the space quickly. This was truly a win-win for the tenant and the landlord”

Berkeley-based affordable housing developer buys South Sacramento land for 74-unit project

Resources for Community Development, based in Berkeley, closed escrow in recent weeks at $1.5 million for about 1.34 acres on Power Inn Road, north of where it meets Geneva Pointe Drive and next to an existing self-storage business. In the application, the firm outlined a four-story, 74-unit affordable housing project called Power Inn Apartments for the property, with one unit designated for a manager. By configuration, the property would have 36 one-bedroom units and the rest either two- or three-bedroom units. The application does not specify the exact number of two- or three-bedroom units or square footages. Total project square footage would be 68,236. Income limits are not outlined in the application.

Local company acquires space in Rancho Cordova

Purchased in early November for $1.525 million, the property has three buildings with a bit more than 10,000 square feet of space on a 1.71-acre parcel. After spending a few years in construction, Mark Hand was adamant: He didn't want to be in it anymore. He certainly didn't want to run his own company in that field, he said.

But after adopting a people-first approach, and some years of cajoling from former colleagues, Hand said, he's happy to now have a permanent home for Classic Fence Co. after recently buying a property in Rancho Cordova."When I realized I could positively enrich team members' lives, that changed the game for me," said Hand, who founded Classic Fence in 2013 but leased space until recently buying 12355 Quicksilver Drive.

Dalfen spends $156.7m for 1.32m square feet

In one of the biggest local industrial portfolio sales of recent years, Dalfen Industrial LLC has acquired 13 buildings and 1.32 million square feet of space from an affiliate of Blackstone Inc for $156.7m. The buildings, all in West Sacramento, have current occupancy of 97% with a variety of tenants. Properties that were part of the portfolio include 840 Riverside Parkway; 840 and 860 Embarcadero; 3600 Industrial Blvd.; 1400, 1420, 1464, 1740-1760, 1800-1810 and 2040 Enterprise Blvd. and 3740 and 3700 Seaport Blvd. Though individual prices for specific properties weren't available, records from the sale closed last week show prices ranging from $8.75 million to $35.7 million in the deeds.

Local investor acquires vacant office buidling

Mohanna Development Co. closed escrow Nov. 14 on 1025 19th St., a 16,400-square-foot office building kitty-corner to the company's 19J project and just west of the popular Lavender Heights nightlife hub for $3.6 millon. Sacramento city records don't show any current applications for the property, which extends from J Street on the north to K Street on the south on the east side of 19th Street. In marketing the properrty in 2021, it was disclosed that the site could hold up to 200 multifamily units as well as ground-floor retail spaces.

520 Capitol Mall sells to state agency for $22.3m

CalHFA paid $22.3 million for the 80,752-square-foot building, or about $276 a square foot. Marcus & Millichap's post described the sale as the highest in Sacramento's urban core on such a basis since 2022. The price is also notable in that it's a relatively small change from the last open-market sale for the property in 2016, when an affiliated entity of LeFever Mattson paid $28 million for it. In early 2022, records show the property changed hands at a higher price of $32 million, though that appears to be between separate entities affiliated with LeFever Mattson, which was headquartered in Citrus Heights. The building was originaly owned by the Sacramento Unified School District , but sold through area broker, Heath Charamuga to a Sacramento BTV Crown Equities.

Petrovich sells Calvine Pointe gas station for $8.6m

The property sold in recent weeks for $8.6 million to G-Tech Fellers Enterprises, with an address in Palo Alto, records show. No contact information was available for that entity, though it appears related entities invest in other commercial real estate properties. At 79,212 square feet, the property includes 16 gas pumps, a 1,141-square-foot car wash and a 3,349-square-foot convenience store. Opened in June of this year, the gas station property was initially listed for $8.8 million. The offering memorandum notes BP Products North America, the property tenant, has a lease that runs through 2040, with four five-year renewal options. Rents rise by 10% every five years. The property is structured as a triple-net lease, so the tenant is responsible for all property obligations such as maintenance and property taxes.

EPIC completes lease for Hiebert USA for expansion

Epic Real Estate Advisors, Inc, one of area’s fastest growing companies and leading provider of integrated real estate services, today announced that Grant Deary has completed a lease with Hiebert U.S.A. at 11353 Sunrise Gold Circle in Rancho Cordova, CA. The leased space is comprised of 7,766 square feet with plenty of power to accommodate the tenants need. Epic’s Grant Deary states “This new space gives the tenant who builds custom auto bodies room to accommodate his need due to an expanded contact for his unique service. John does more than metal fabrication, he is an artist.” Hiebert U.S.A. builds custom chassis and replica bodies for the 1966-77 Ford Bronco. The Rancho Cordova location will allow the builder to more than triple his current production as he prepares to ship additional units across the country.

Buzz Oates sells West Sacramento property for $9.1m

A fully leased West Sacramento industrial building has been sold by commercial real estate giant Buzz Oates.

The property at 3920 West Capitol Ave. sold to Stegner San Bruno LLC, with an address in Los Gatos, according to property records. In an email, Buzz Oates asset manager Jason Law said, "3920 West Capitol is a high-quality, functional small-bay industrial asset that has consistently delivered strong performance for us.

"Its efficient suite layout, recent reconfiguration, and strategic location in West Sacramento have kept the property fully leased and highly competitive," he said. 3920 West Capitol Ave. sold for $9.1 million. At 53,386 square feet, the per-square-foot-sales price was about $170.

Cordova Village center sells for $20.25

Jim Pattison Developments US Inc., based in Vancouver, British Columbia, has bought the Safeway-anchored Cordova Village shopping center in Rancho Cordova from the original developer. According to records, Jim Pattison Developments paid $20.25 million for the 60,617-square-foot center, or about $334 a square foot. A message left with the company earlier this week wasn't returned. The company develops and invests in several kinds of commercial properties, according to its website. In addition to Safeway, Cordova Village has a Safeway-branded gas station and Bank of America branch as tenants on 7.6 acres and is currently 100% occupied.

EPIC sells Folsom asset for $3.6m to local investor

Epic Real Estate Advisors, Inc., one of area’s fastest growing commercial real estate local investment funds and the leading provider of integrated real estate services, today announced that it has sold a commercial office/retail building at 118 Woodmere Road located in Folsom, California. The building, which totals approximately 22,140 square feet, sits on approximately 1.25 acres sold for $3.6 million. The asset had been partly owned for the last 20+ years by the existing tenant, Hawkins School of Performing Arts, who will remain in a portion of the building going forward. Epic’s Scott Laeber states “With the consolidation of the performing arts school, there are now two spaces available for lease which we have been able to generate multiple offers on for the new ownership”. The building, which sits just off Folsom Boulevard, has filled a need in the marketplace for many years. The buyer, John Ryan Williams, owns other area properties and likes the opportunity the building represents in the Folsom marketplace, where smaller tenant spaces are limited. Epic’s team of Charamuga and Laeber, who had the listing on the asset for sale, had generated multiple offers though their disposition process.

Roseville's former Claim Jumper site sells for $2.2m

A long-empty restaurant property in Roseville has taken a step toward a new future, with the property selling in an online auction that concluded Tuesday morning. The property at 250 Harding Blvd. best known as the home for Claim Jumper garnered a high bid of $2.2 million in the auction, conducted by Tranzon Asset Strategies. Tranzon's list of bids did not identify the bidding entities beyond an ID number, though the one that submitted the highest bid had been highly active through the auction's final hours since submitting a bid for $1.465 million on Tuesday morning.

Two apartment projects in West Sacramento Sell

Two apartment properties that haven't been sold in decades have new owners in West Sacramento and Fair Oaks.

Rivergate, a 126-unit property at 900 Simon Terrace in West Sacramento, and Arlington, a 36-unit property at 10930 Fair Oaks Blvd. in Fair Oaks, sold in separate deals for the first time since the 1990s. IMG Rivergate LLC, with an address in San Ramon; Bungalowz LLC PS 1 and Team Holdings I LLC bought Rivergate for $15.5 million, records show. The per-unit price is about $123,000 for a property built in 1976. Arlington, which was built in 1971, sold for $6.7 million in an off-market deal to LZ Khan Investments LLC, with an address in Fair Oaks. The per-unit price was about $186,000.

FPA Multifamily Buys back project for $33.5m

Less than four years after selling a 198-unit apartment property in Carmichael, FPA Multifamily appears to have bought it back. Records show VA9 Skylark Place LLC, with an address in Irvine, bought the ReNew Fair Oaks apartments at 7000 Fair Oaks Blvd. in recent weeks. The Irvine address for the buyer is Trinity Property Consultants, an in-house property management firm for FPA. According to the sales record, the new owner paid $33.5 million for ReNew, or about $169,000 a unit. That's a drop from what FPA sold it for in December 2021 to Trion Properties, for $46 million.

Jackson Square buys 272-unit Falls at Arden

Jackson Square Properties has closed escrow on a 272-unit apartment property in Arden-Arcade, and has a big change planned for part of it. At least 40% of the units at The Falls at Arden, at 2345 Northrop Ave., will be designated to have rents affordable to people making 80% of area median income, said the company's chief investment officer. Built in 1986, Falls at Arden, selling at $54.6 millon or $200,000 per unit, has units ranging from studios to two bedrooms, with an average square footage of 679. Amenities include a pool deck and spa, fitness center and a renovated clubhouse with demonstration kitchen, game room and movie theater.

The UV center at Fair Oaks and Howe sells for $51m

A shopping center at one of the region's busiest intersections has been sold as part of a $625 million portfolio deal.

Elmsford, New York-based DLC announced Monday that it acquired The UV at Fair Oaks Boulevard and Howe Avenue as one of 10 retail properties in the deal. DLC, which bought the properties in a joint venture in a fund managed by DRA Advisors LLC, didn't return a message left for comment on Monday. Peter Merlone, co-founder and co-owner of the seller, Merlone Geier Partners. According to records, the buyers paid $51 million for The UV, which is listed as having 84,346 square feet on DLC's website. The sales price works out to a bit more than $604 per square foot.

Safeway-anchored Elk Grove center sells for $19.1m

A neighborhood center in Elk Grove recently added the new 55,000 square foot Safeway grocery store anchor, making it an investment with upside for Los Angeles-based Bershon Realty Company. The company recently acquired Shops at Laguna Reserve, a 4.16-acre shopping center, for $19.1 million, according to a brokerage representing Bershon in the deal. At 33,308 square feet, the center sold for about $573 a square foot.

EPIC completes lease for Ululani's Hawaiian Shave Ice

Epic Real Estate Advisors, Inc, one of area’s fastest growing companies and leading provider of integrated real estate services, today announced that it has completed a retail lease for Ululani’s Hawaiian Shave Ice at 1013 Second Street in Sacramento, CA. The new location is comprised of 1,946 square feet and located in Old Sacramento. The franchisee chose Epic’s Stuart Snider to source new locations for the expanding concept. The Sacramento location will be the chain’s fifth California store. Ululani’s calls itself "Maui’s favorite spot for the world’s most delicious shave ice." The franchise chain has locations in California, Florida, Hawaii and Texas. “We are excited to be able to facilitate the needs of such a unique concept to the region. This is a win for Sacramento.” states Stuart Snider of Epic Real Estate Advisors, Inc., who represented the tenant.

Flint Buys North Auburn commercial condominium

Flint recently closed escrow on a commercial condominium of 70,000 square feet at 12600 Locksley Lane in North Auburn, property records show. "We grew out of the facility we had in Roseville," said company President John Stump. "We're going to use it for fabricating commercial building components." According to records, Flint paid $10 million for the condo, one of two at that address and seven times the size of its site in Roseville. At the North Auburn site, Flint will expand existing lines to pre-fabricate interior and exterior wall panels as well as volumetric work, steel fabrication and composite assembly, Stump said.

Davis Apartments Sell for Record Price

Apartments opened last year in Davis' Cannery project have sold for one of the highest per-unit prices in the region this year. Records show MarCo at the Cannery, a 72-unit, market-rate property at 2500 Cannery Loop in Davis, sold for $29 million to business entities with local addresses. The sales price works out to about $403,000 per unit. According to a Kidder Mathews marketing brochure for the property, MarCo was 100% leased after opening last year.

EPIC represents California Water Servce Group on purchase

Epic Real Estate Advisors, Inc, one of area’s fastest growing companies and leading provider of integrated real estate services, today announced that it has facilitated the acquisition of a parcel for California Water Service Group. Epic’s Stuart Snider was tapped to represent California Water Service Group (NYSE: CWT), the largest regulated water utility operating in the western United States. CTW provided high-quality, reliable water and/or wastewater services to more than 2.1 million people in California, Hawaii, New Mexico, Washington and Texas. The needs of CTW were not simple, Stuart was to help CTW secure a location for a new well to provide additional water service to Oroville’s local community’s peak water demands for the next 50-75 years. Epic’s Stuart was able to source a 1.13-acre site at South 7th Avenue which allowed the local operating utility to secure the necessary rights to drill and build the needed infrastructure required by the contract. Epic’s Stuart states “It was a little like finding a “needle in a haystack”, but that’s what we were able to do. The options were limited, but in the end, we were successful and the community of Oroville will benefit”. The utility’s local manager, Loni Lind states "This important water system upgrade will help us continue to provide a reliable supply of high-quality water both for our neighbors in Oroville and for fire protection in emergencies. Our infrastructure improvements are all about providing quality, service, and value to the communities we serve."

Howe Manor Apartments fetches $18.9m

For the first time since it was developed in the 1960s, an apartment property on Howe Avenue in Arden-Arcade has a new owner. Howe Manor Apartments, a 152-unit property at 950 Howe Ave., sold to FPA Multifamily, based in San Francisco. On 4.58 acres, Howe Manor has one- and two-bedroom units in two-story buildings, with Apartments.com showing one-bedroom units at about 590 square feet. That site shows no units currently available, though rents are listed at $1,300 to $1,500 a month. The property sold for $18.875 million, which works out to about $125,000 a unit.

Post Real Estate Group acquires affordable housing project

With the previous owner's plans for the property complete, Rancho Cordova Apartments in Rancho Cordova has a new owner. Beverly Hills-based Post Real Estate Group, a division of Post Investment Group, closed escrow in recent weeks on the 95-unit affordable housing property at 10685 Coloma Road. Records show Post Real Estate bought the property for $12.95 million, or about $136,300 a unit. Built in 1971, Rancho Cordova Apartments was redeveloped using low-income housing tax credits in 2002.

Woodcreek Plaza sold ot Bay Area buyer

One local commercial property that came to market as a result of a complex bankruptcy case has sold, while another is on the path to doing so. The retail property Woodcreek Plaza in Roseville sold last week to a Bay Area buyer, stemming from the bankruptcy of Citrus Heights-based LeFever Mattson Property Management. Woodcreek Plaza is a 95% occupied, 22,650-square-foot retail property at 7456 Foothills Blvd. Nelson said Wood Creek Plaza LLC, with an address in South San Francisco, bought the property on Sept. 10 for $7 million.

Whiting-Turner aquired Woodland site for $6.3m

After the previous owner moved a truck accessories operation to Mexico, 1686 E. Beamer St. in Woodland sat on the market for about a year. Now there's a new owner in the form of The Whiting-Turner Contracting Company, which closed escrow on the 8.54-acre property on Sept. 8th. The company paid $6.3 million for the property, developed in 1970.Until last year, Leer Truck Accessory Center occupied the site. But after private equity firm J.B. Poindexter & Co., Leer's owner, closed the operation there, most of the interest came from firms seeking to use it as an outdoor yard property.

Ethan Conrad makes additional retail purchase

Another piece of retail property Antelope Crossing in Antelope has come under the ownership of investor Ethan Conrad. In late August, the prolific commercial property investor acquired 4207 Elverta Road, which is just west of a piece of Antelope Crossing he already owns at 4249 Elverta Road. Conrad bought 4.2-acre 4207 Elverta Road, a 22,637-square-foot property fully leased with seven tenants, for $6.85 million, records show. He said the deal was off market. Tenants include Petco, a UPS Store, Mountain Mike's Pizza, Tobacco Plus and Adalberto's Mexican Food. For Ethan Conrad Properties, the purchase makes sense because the firm owns a directly neighboring retail building in Antelope Crossing recently leased to Chuze Fitness, Conrad said in an email.

Los Angeles investor spends $12.2m on apartment property

For the second time this year, a multifamily investor based in the Los Angeles area has gone shopping in the Sacramento market. The same entity that bought River Cove Apartments two months ago has bought Pointe Townhomes, a 64-unit property in Arden-Arcade. Pointe Townhomes Associates LLC is shown in records as the buyer on Aug. 27, 2025 of Pointe Townhomes, at 1500 Howe Ave., for $12.2 million. The price works out to $190,625 per unit and about $190 per square foot for the property, which has two-story, 1,005-square-foot townhouse apartments that each have two bedrooms.

$9m sale of industrial building in West Sacramento

According to records, Norcal Solutions bought the 2.88-acre property with about 61,650 square feet of rentable space for $9.05 million. The property is located at 1105-1107 Terminal Street, in West Sacrament and was home to a cannabis related tenant. The sale also reflects the realities of the industrial market overall at the moment, he added. While large institutional buyers have mostly backed off, private capital buyers are still active, and owner-users like Norcal Solutions especially so.

California water agency buys Roseville office building

A joint powers authority that sells insurance for state water agencies has found a future home that's three times the size of its current office, closing escrow recently on 532 Gibson Drive in Roseville for $8.07 million. After months of searching, a firm that provides insurance to California water agencies has found a bigger future home in Roseville. Adrienne Beatty, CEO of the Association of California Water Agencies Joint Powers Insurance Authority, said the size her group needed — up to 50,000 square feet — made the search tough. "We wanted to stay in the Roseville area, but there were very few options in our size range," she said, describing how ACWA JPIA had outgrown its current building on Professional Drive in Roseville about 15 years after buying that one.

Mourier acquires Roseville office building for $9.5m

Records show Mourier Land Investment Corp. closed escrow in July on 1508 Eureka Road in Roseville, its seventh property in that city. The company paid $9.5 million for the two-story, 52,214-square-foot building, according to property records. Built in 2003, 1508 Eureka doesn't appear in property records to have ever previously been part of an arms-length sale. Current building tenants include Placer Title Company, Benn & Leman CPAs and Sproul Trust LLP. Eureka Development Co. LLC is listed as the seller for the property, with an address at 1508 Eureka Road.

Closed Marie Callenders' site sold may be future home of Chick-fil-A

No firm word on what business might replace it, but redevelopment of the closed Marie Callender’s restaurant in Citrus Heights is closer after a recent sale. Rumors are circling that the site may house a Chick-fil-A in the future. Patterson Properties bought former Marie Callender’s restaurant for $2.2 million. City approved demolition and construction of new drive-thru restaurant. Demolition doesn't appear to have gotten underway yet for the building, which hasn't had a tenant since Marie Callender's closed in 2019, the same year the restaurant chain known for pies filed for bankruptcy.

Fully leased office building sold in North Natomas

A North Natomas office building sold in 2019 didn't appreciate by much in a new sale that closed in recent weeks. But given the general down market for office overall, that's a sign for optimism. The sale of fully leased 3900 Lennane Drive recently to a local investor for $6 million, or more than 40% over its previous sales price. Built in 1978, the building at 3900 Lennane is 46,149 square feet but has been extensively renovated. It is noted that the weighted average lease term for its tenants is more than five years, while most of its tenants have signed on since 2022.

ABS buys entitled apartment site for AG Spanos for $11m

According to records, the company bought 14533 Alder Creek Parkway in the Folsom Ranch development, a site approved for a 265-unit project in Folsom. Advanced Building Solutions, which is affiliated with Golden State Lumber, bought the 10.7-acre site for $11 million. A message left with the company wasn't returned. The sales price is nearly twice the $5.8 million the site sold for previously in 2022. Stockton-based AG Spanos Companies, a multifamily developer, was the buyer in that deal and the seller in the new deal. A message left with AG Spanos on Monday wasn't returned. The company has an active project under construction in North Natomas.

The $100m acquisition of Sierra View Business Park, Roseville

NorthPoint Development Inc. has expanded its local footprint in one of the biggest industrial purchases in the region this year. Records show Kansas City, Missouri-based NorthPoint closed escrow earlier this month on Sierra View Business Park, a fully leased, 712,733-square-foot industrial property in Roseville. Sierra View Business Park, which encompasses 8855-8875 Washington Blvd. and 8860/8880 Industrial Ave., sold for $97.5 million, according to sales records. That sales price is a gain of 67% over the property's last sale price of $58.25 million in 2018 to Talos Capital, which had a partnership at the time with The Blackstone Group LP.

EPIC helps Moirae Brewing Co. secure new location

Epic Real Estate Advisors, Inc, one of area’s fastest growing companies and leading provider of integrated real estate services, today announced that it has completed a retail lease for Moirae Brewing Company at Cameron Park Plaza Shopping Center in Cameron Park, CA. When the centers ownership disclosed to his leasing broke, Epic’s Stuart Snider, that his existing brewery tenant at the property was not interested in extending their lease, Stuart went to work. Stuart, in short order, was able to source and secure, via a new lease with a tenant willing to, not just take over the space, but purchase existing business as well. “It’s about seeing a need and filling a need…it’s what I do. Keeping in touch with local and regional tenant allows me to respond immediately and act quickly to fill vacancies” states Stuart. The brewing company owners, Zach and Ariela Grinnell, who after spending years in Boston, moved back to the west Coast, then settled in El Dorado Hils with hope of opening their brewery, but COVID placed a hold on their dream. That dream is now reality at Cameron Park Plaza. 2025 has proven success for this family run, brewing business. Moirae Brewing Co. picked up medals for three of its brews at the El Dorado County Fair, winning a double gold for its Von Hammersmark German-style Pilsner, a silver for its Stowe Away hazy IPA and a bronze for its Hazel’s Nuts! spiced beer.

Tim Lewis Communities gets former Sacramento Bee site

A transition has begun for one of the best-known sites in Midtown Sacramento, with a new owner buying the former home of The Sacramento Bee and the building's demolition underway. Records show the Roseville office of homebuilder Tim Lewis Communities in recent weeks bought 2100 Q St., which has city approval to be redeveloped into 62 townhomes and 60 single-family homes. Tim Lewis Communities paid $18.5 million for the 6.28-acre site with nearly 381,000 square feet of building space on it.

EPIC sources new location for Pizza Factory

Epic Real Estate Advisors, Inc., one of area’s fastest growing commercial real estate local investment funds and the leading provider of integrated real estate services, today announced that it has sold a commercial project located at 7310 CA State Hwy 49 located in Lotus, California. The multi-tenant building, which totals approximately 10,531 square feet ands sits on 1.13 acres nestled along the American River, became home to the Buyer, Neher Enterprises and their Pizza Factory franchise earlier this year. The operator recently completed a major update and full remodel of the restaurant space incorporating many local historical references including mining, gold panning, rafting and kayaking. The property, which recently had undergone a complete repositioning by Epic Real Estate Advisors, Heath Charamuga and Scott Laeber, offers area tenants a working environment focused on the adjacent South Fork American River and tenants sharing property amenities. Epic’s Laeber states, “The owners of Pizza Factory see the vision being created and positioned their business to reap the benefits. Now they own the property which they occupy with a newly extended US Post Office lease and additional space for an new concept they will be adding in 2026.” River Park Village Shopping Center continues to be the area’s community hub with pizza, bakery, dog grooming, massage, US Post Office, 24-hour gym, photography studio, real estate, insurance and legal offices in addition to mini-storage. Epic, who is selling the assets for a local family out of Auburn, has two additional parcels available for disposition.

Macy's Downtown Commons Building Sells for $15m

The Shingle Springs Band of Miwok Indians has doubled its real estate footprint in Downtown Sacramento, closing escrow on the former Macy's store at Downtown Commons. The tribe, affiliated with Red Hawk Casino near Placerville, announced the purchase of the building at 414 K St. Thursday for $15 million. By owning that and 414 K St., the tribe now owns two full-block sites in the heart of Downtown Sacramento. Heath Charamuga of Epic Real Estate Advisors, who was familiar with the transaction states, "Macy's held off on the property sale for years due to its commitment to downtown Sacramento and the region."

Cottonwood Residential buys 805 Riverfront St., West Sacramento

Two years after it opened, one of West Sacramento's largest apartment complexes has sold in the second-biggest multifamily deal this year in the Sacramento region. 805 Riverfront at 805 Riverfront St. sold in June to Salt Lake City-based Cottonwood Residential, making its first local move. Cottonwood, which invests in and develops multifamily properties, didn't return a message left through its website. The site shows 805 Riverfront as its only property in California. Records show Cottonwood paid $108.4 million for 805 Riverfront. With 285 units, the property sold for about $380,000 a unit, but there is also 10,000 square feet of ground-floor retail space.

Local investor buys Rocklin retail building for $3.8m

A fully leased building within a Rocklin retail property has sold, with a difference from most sales of its kind recently. Next Investment LLC, with an address in Sacramento, bought the two-tenant building in Sunset Station at 2303 Sunset Blvd. earlier this month. Next Investment paid $3.8 million for the 6,122-square-foot building, records show. Built in 2022, 2303 Sunset Blvd. is about an acre and is near a shopping center anchored by a Bel Air supermarket. The building's two tenants, U.S. Bank and Animal Urgent Care of Rocklin, are both on long-term, triple-net leases, meaning the new owner has no property responsibilities.

Conrad acquires second building at Gold Pointe Corp. Center

Three years after a San Francisco firm bought a Class A office building in Gold River with belief in a rebounding office market, it's sold again, out of a foreclosure situation. Conrad said in an email that his firm paid $8.06 million for the three-story, 107,934-square-foot building. That price is a 41% drop from the $13.25 million Bering Capital paid for it in 2022. The building is about 30% leased. Because it was in foreclosure, leasing activity was light in recent months. Investor Ethan Conrad closed escrow last week on 12009 Foundation Place, making it the second building in Gold Pointe Corporate Center his company owns.

Two apartment project sell in Roseville for over $10m each

Recent sales of two apartment properties in the Sacramento region are signs of shifts in the investment market for that sector. River Cove, at 6290 Fennwood Court, sold for $11 million, or about $185,000 per unit. The 1973 apartments are a combination of one- and two-bedroom units, with an average square footage of 860 square feet. Sierra Gardens, at 1645 Sierra Gardens Drive in Roseville, sold for $10.5 million, or about $142,000 a unit. Apartments there are also either with one or two bedrooms, ranging from 650 to 1,050 square feet. The property dates to 1960.

Brixton Capital buys Elk Grove Village for $10.6m

Brixton Capital has expanded its investment in the Elk Grove Village shopping center beyond an anchor drugstore. The real estate investment firm announced it acquired four parcels of the center that appear to constitute about 30,000 square feet of retail space. According to a news release from Brixton, the firm bought 8511-8591 Elk Grove Blvd. for $10.6 million. The new owner is planning improvements over the next five years that include new doors, a roof and parking lot renovations. Elk Grove Village, built between 1984 and 1988, is fully leased with tenants that include MacQue's BBQ, Plaza del Sol restaurant and Papa Murphy's Take 'N' Bake Pizza. SF Supermarket is planning to open a new store in a former Big Lots space in the center after buying it earlier this year.

New tenants possible after Carmichael property sale

Lincoln Orellana, whose Chino-based company Orellana Family Community Properties recently closed escrow on 6019 Fair Oaks Blvd. Sacramento Sports Center, will focus on high-level athletic training for junior high to professional athletes. Records show his firm bought the 23,000-square-foot building at 6019 Fair Oaks Blvd. for $3 million, about two months after seller Mehrizi Properties LLC bought it as part of a $2.1 million purchase of 6001-6019 Fair Oaks Blvd. In addition to Sacramento Sports Center, 6019 Fair Oaks Blvd. will house Kime Performance Physical Therapy, moving from a location on Tribute Road, and Optimum Athletes, which specializes in building arm strength for baseball and softball pitchers.

Costco acquires 92 acres for distribution center at Metro Air Park

According to records, Costco paid $42.9 million for the land, which is within the part of Metro Air Park planned for industrial development. Warehouse store giant Costco has bought 92 acres in Metro Air Park from one of the primary landowners and developers in that Sacramento County commercial project. The land has an address on Elkhorn Road, which touches the southeastern edge of it. The application called for a 949,000-square-foot distribution center with parking for 840 trucks and 480 passenger vehicles. The building would also have office space and an unspecified number of cross-dock loading bays. Perspective renderings show the building would have a "U" shape, with docks both within and outside the interior area.

AKT Development buys over 200 acres in Rancho Murieta

AKT Development Corp. has made a move into Rancho Murieta, recently closing escrow on more than 200 acres that could be potentially developed.

The property, with an address of Jackson Road, is zoned by Sacramento County as general agriculture/planned development and is west of the unincorporated community's general aviation airport. Records show AKT paid $9.7 million for the 202.7 acres of undeveloped land. The company, the largest land development firm in the Sacramento region, didn't return a message seeking comment on the purchase.

Newer retail center, Willow Creek, in Auburn sells for $28m

The brokerage closed the recent sale of the 67,825-square-foot center at 2825 Grass Valley Highway in Auburn to a Bay Area-based investor for $27.75 million.

Anchored by Smart & Final, the center built a bit under a decade ago has tenants that include PetSmart, Starbucks, Chick-fil-A and Panda Express. According to property records, the buyer was The Shops at Willow Creek LLC, with an address at a home in San Jose. The offering memorandum for the property had an asking price of $29.73 million.

Local investor acquires South Natomas office building for $6.77m

Property records show Felipe Martin and Katherine Elizabeth Martin, with an address at a commercial building on Folsom Boulevard in Sacramento, purchased 2750 Gateway Oaks Drive. The address for the buyers corresponds to Martin Brothers Construction Inc., a general contracting company that appears to mostly work on public projects. Records show the new owners paid $6.77 million for 2750 Gateway Oaks, a three-story, 81,391-square-foot building built in 1998. That's a bit more than half of a 2014 appraised value of $12.7 million, though the last actual recorded sale of the building, in 2005, was for $3.22 million.

Lincoln buys two Sacramento region apartment properties

Lincoln Avenue Communities has bought two multifamily properties in the Sacramento region, paying more than $42 million, after buying a larger one near one of them late last year. Months after buying one Sacramento region multifamily property, Santa Monica-based Lincoln Avenue Communities has picked up two more. Records show the company, which specializes in investing in and managing affordable housing properties, bought 141-unit Bridges at Five Oaks in North Highlands and 76-unit Bellwood Park in Sacramento in two separate transactions. Lincoln Avenue paid $27.75 million for Bridges at Five Oaks at 5520 Harrison St., or about $196,800 a unit. The purchase price for Bellwood Park, at 339 Bell Ave., was $14.5 million, or about $190,800 a unit.

Buzz Oats affiliate sells leased building near Power Inn for $12m

An arm of Sacramento-based development company Buzz Oates has sold a fully leased industrial building in the Power Inn Road area. PW Fund B LP, which has the same address as Buzz Oates in Downtown Sacramento, is listed as the selling entity for 8451 Rovana Circle, a 109,200-square-foot building on a 5.57-acre site. Records show the buyer as Deep Galaxy LP, with an address in Roseville. Deep Galaxy paid $12 million for the property. The building appears to be leased by L&U Granite and Cabinet Outlet and Amador Moving Service Inc. Both companies appear to have been in the building for about 15 years, according to real estate information website Reonomy.

Greystar buys West Sacramento apartment complex for $42.8m

Real estate investment and development firm Greystar has purchased a 192-unit West Sacramento apartment property, according to records, at a hefty discount from the property's last sale. Records show Greystar, based in Charleston, South Carolina, paid $42.8 million in recent weeks for 850 on the Avenue, with an address of 850 Sacramento Ave. Compared to the property's most recent previous sale, in 2022, Greystar paid 26% less than the last buyer.

Oracle Properties buys industrial building in West Sacramento

An industrial building empty since a Wisconsin-based company closed its location there last year has been sold to a new owner. Records show Oracle Properties Development Inc. closed escrow in recent weeks on 1201 Shore St. in West Sacramento, previously occupied by Quad/Graphics Inc. Built in 1969, the building at 1201 Shore St. appears to have been vacant for more than a year, after Quad/Graphics filed a notice in early 2024 with the California Employment Development Department that the company was closing the location and laying off 56 employees there.

EPIC completes one of the largest office sales in 2025

Epic Real Estate Advisors, Inc., one of area’s fastest growing commercial real estate local investment funds and the leading provider of integrated real estate services, today announced that it has sold a commercial office building at 104 Woodmere Road located in Folsom, California. The building, which totals approximately 84,756 square feet, sits on approximately 9.80 acres sold for $13 million. The asset, parked at 6:1,000 has been vacant for the past few years, was home to Mercury Insurance. Epic’s Heath Charamuga had been tasked with sourcing a new location for the Muslim Community of Folsom (MCF). Heath states, “We had looked extensively in the area, but most locations were sites that MCF would have to build on; the purchased site at 104 Woodmere Road offered an existing asset sitting on almost 10 acres, offering the buyer existing space to facilitate its uses today, while offering a site large enough to accommodate future needed expansion.”

The building, built in 1984, which sits just off Folsom Boulevard, is surrounded by commercial amenities including the adjacent Willow Creek Plaza and the Folsom Premium Outlets. Building amenities include a 4,000-amp electrical service with a 500 FW backup generator and 125 KVA UPS backup battery.

Investor makes bet on purchase of 308,000 sf office building

Real estate investor Max Boyko has closed escrow in one of the largest office property deals this year: 9100 Foothills Blvd. in Roseville. Boyko said he liked the future prospects for the three-story, 308,423-square-foot building, even though it's currently vacant. Escrow closed Thursday at $13.575 million for the building, built in 1998. Until about two years ago, Sutter Health occupied the building, but used it as administrative rather than medical office space.

EPIC capatures Bay Area Waterproofing Company for local asset

Epic Real Estate Advisors, Inc, one of area’s fastest growing commercial real estate local investment funds and the leading provider of integrated real estate services, today announced that agents Grant Deary and Heath Charamuga has filled the commercial industrial building at 955 Fee Drive located in Sacramento, California. The building, which totals approximately 16,000 square feet will be home to California Waterproofing Supply, who already has two locations in Southern California and one in the Bay Area. The Sacramento location just off Interstate 80 at Hwy 160 will allow the company to access the Northern and Central California. The family owned and operated business has a 40+ year history in providing waterproofing supplies. “The property’s visibility along Hwy 160, proximity to I-80, and flexible zoning made it a strong fit for a supply and distribution user like California Waterproofing Supply.” States Grant Deary, of Epic.

Roseville Shopping Center sold to Bay Area group

A shopping center on one of Roseville's older commercial corridors has sold for the first time in decades. Harding Plaza, at 212 Harding Blvd., sold in late April to Harding Plaza LLC, with an address in the Bay Area. A Danville-based new ownership group acquired the property. Public records show the 47-year-old, 81,635-square-foot center sold for $13.25 million. That's below a listing price of $14.7 million advertised earlier this year. The property is 94% occupied, with only a 6,400-square-foot space available.

Sutter Capital acquires part of Rancho Cordova Sportsplex

Sutter Capital Group bought part of the Sportsplex property in Rancho Cordova for $9.5 million. The 94,060-square-foot building, sitting on 5 acres, houses sports- and recreation-based tenants. According to records, the Sacramento-based company closed escrow recently on part of a property known as Sportsplex at 11327 Folsom Blvd. The specific building at 11327 Folsom Blvd. is fully occupied with several sports- and recreation-based tenants, including indoor playground and event center Wacky Tacky, gym equipment retailer Fitness Outlet, OMNI Volleyball Club and basketball training center Touch Shooting.

Three-building industrial property trades for $10.05m

A fully leased industrial property of three buildings in Rancho Cordova has sold in an off-market deal, showing appetite for such properties even as development of new ones has slowed. Todd Berryhill and his Mercantile Industrial LLC bought the 78,400-square-foot property for $10.05 million on April 17, according to public records. the property is currently fully occupied, and Rancho Cordova is known as a tight market.

Expo Center Industrial Park sells for $17.55m

Sword Industrial Partners paid $17.55 million for Expo Centre, which has 121,816 square feet of space across seven buildings and 7.7 acres. Current occupancy is around 70%. The previous owner spent about $5 million on property upgrades and reconfigurations that helped create newly leasable space within the center, which was built in 1975. With bays ranging from 1,500 to 6,600 square feet, Expo Centre has a niche hard to find in the northeast part of Sacramento, where most industrial properties have either larger spaces or a single tenant.

EPIC completes lease for Opal Massage

Epic Real Estate Advisors, Inc, one of area’s fastest growing companies and leading provider of integrated real estate services, today announced that it has completed a retail lease of Opal Massage at Southgate Square Shopping Center in Sacramento, CA The new location is comprised of 1,100 square feet and located just off Hwy 99 and Florin Road at the intersection of Meadowgate Drive and Franklin Boulevard at 7298 Franklin Boulevard. The renowned massage-spa specializes in providing a variety of therapeutic massages tailored to individual needs. Epic’s Stuart Snider states, “When the ownership approached me about listing the center for lease, I already had a handful of tenants looking to secure space in the area.” Opal Massage, who already had a strong list of loyal clients, looks to offer their specialized massage-spa experiences to new area customers.

GPR Ventures acquires Johnston Business Park for $11.16m

GPR closed escrow on 191 Lathrop Way, a single-story office and industrial building of about 32,000 square feet. Built in 1988, 191 Lathrop Way has tenants that include AAA Electrical Services, NorCal Physiotherapy and Sports Sciences Inc. and Global Protection and Investigations. The purchase also appears to represent an ongoing repositioning for GPR Ventures locally, with the firm selling more of its office holdings and buying more industrial properties in recent years.

Former gym closed since 2023 has a new owner

Built in 2004, the building at 1900 Del Paso Road had a series of fitness center tenants over its history, including Gold's Gym, Fit Republic and most recently Elements Health Club, which closed is location there in October 2023. Though a couple fitness centers were interested, he said, a church put in a bid and closed escrow March 31 on the 42,000-square-foot building on 3.44 acres for $6.5 million. Real Life Church was the buyer.

EPIC helps Niello Company with expansion needs

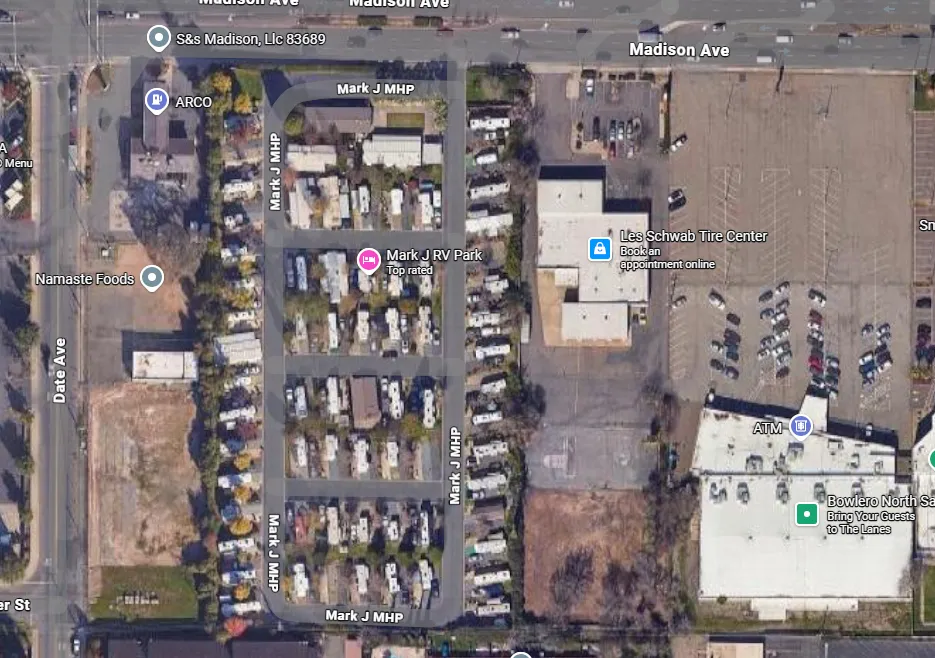

Epic Real Estate Advisors, Inc., one of area’s fastest growing commercial real estate local investment funds and the leading provider of integrated real estate services, today announced that it has represented Niello Company on securing additional land at 4750 Madison Ave located in Sacramento, California. The land which Epic’s Heath Charamuga recently sold to the Siddiqui family was vacant and Charamuga approached ownership with a need from Niello. The 1-acre site, less than 1,000 feet from Niello’s Volvo dealership will accommodate storage of additional inventory. Epic’s Charamuga states, “Niello was in need for additional space and this 1-acre site just across the street makes sense for a multitude of reasons. The site will allow Niello additional vehicle storage space that is safe and secure.”

The site sits adjacent to Les Schwab Tire Center, sits just off Madison Avenue adjacent to Bowlero.

Two apartment properties sell for a combined $27.3m

Records show Danville-based Tilden Properties closed escrow in recent weeks on 80-unit The Everette Apartments in Rocklin, and Sacramento-based Parkhills Place Holdings LLC bought the 90-unit Park Hills Place property in South Land Park. According to records, the buyer paid $10.725 million for Park Hills Place, for about $119,000 a unit for a property located at 6050 S. Land Park Drive. Separately, Everette Apartments, at 3300 Parkside Drive in Rocklin, sold for $16.6 million to Tilden Properties.

LDK Ventures makes purchase at Metro Air Park

LDK Ventures, which owns McClellan Business Park in Sacramento County, closed escrow last Friday on 7070 Badiee Drive, a 109,332-square-foot building also known as Metro Air Park Logistics Center III. LDK Ventures is shifting its attention to either build-to-suit projects at McClellan or investing in buildings like 7070 Badiee that are in key locations and, in this case, can be divided into smaller spaces.LDK paid $14.5 million for 7070 Badiee, in the first move of a new partnership with Blue Coast Capital in Roseville. Marketing has begun to split the space for lease to two tenants in the building, which Badiee Development opened last year.

Kader Investments makes $13.5m purchase in Folsom

Kader Investments paid $13.5 million for 107 Woodmere Road, a 57,500-square-foot building used as both office and industrial space for tenant Stellant Systems Inc.

The tenant recently extended its long-term lease at the building, which also underwent a series of tenant improvements, including new paint, parking and overall remodeling. Stellant, which has five manufacturing sites in the U.S., builds spectrum radio frequency/microwave power amplification products for a number of industries, including space, defense, medical/scientific and industrial.

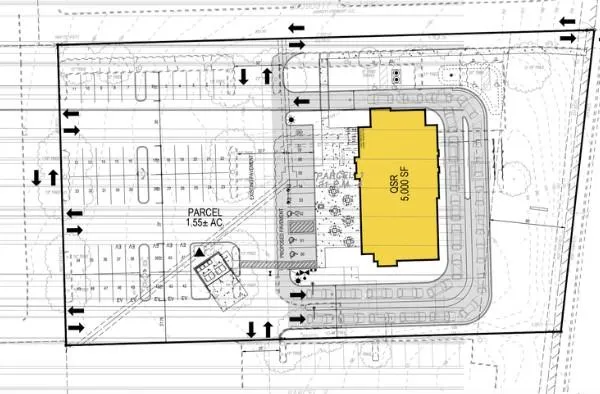

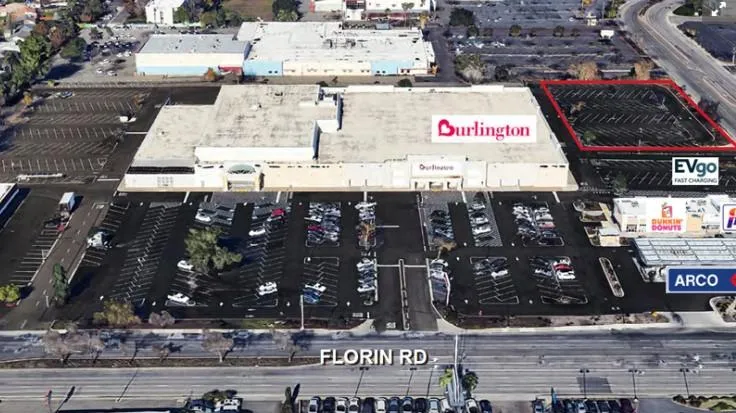

Conrad buys Burlington Stores site on Florin Road

A Burlington Stores Inc. location on Florin Road in Sacramento County is slated for some changes after the property sold last week.

Real estate investor Ethan Conrad acquired the site at 5601 Florin Road, near parts of the former Florin Mall he also owns. Conrad said he bought the property, a two-story building of about 156,000 square feet on a 12.3-acre property, for $5.885 million. As a result of the purchase, Burlington, formerly known as Burlington Coat Factory, will shrink its own footprint on the site to 34,652 square feet, on a new 10-year lease, according to Conrad.

Bay Area nonprofit purchases Sacramento properties

An Oakland-based group known for efforts to house people without housing has scooped up more properties in the Sacramento region, including one near Downtown Sacramento. Records show Bay Area Community Services bought both office building 501 S St. near Downtown Sacramento and multifamily property 116 5th St. in West Sacramento's Broderick neighborhood. According to records, the group bought 501 S St. for $2.12 million, and 116 5th St. for $1.12 million. The office building at 501 S St. is on nearly a full quarter-block property and is 8,376 square feet, while the full .44-acre property also includes parking. The group made its first move into the region recently by buying the former Travelodge property at 623 16th St. in Sacramento for $4.5 million.

River District office building Lease to Cal OES - SOLD

With a lease renewal in place, an office building in Sacramento's River District bucked the trend of investor skepticism of such properties, according to a broker on its recent sale. Sequoia Pacific Investments LLC closed escrow in recent weeks on 630 Sequoia Pacific Blvd., a 38,827-square-foot building fully occupied by the California Governor's Office of Emergency Services. Records show the buyer paid $7.575 million for the building, which was built in 1990 as a planned project for Cal OES. The state agency recently renewed its lease there and because of both what it's spent to keep the building updated and its proximity to agencies such as the California Highway Patrol, is unlikely to leave anytime soon.

3-Story K Street Building sold to Bay Area Group

After falling into foreclosure in 2023, 1106 11th St. in Downtown Sacramento has been purchased by a Bay Area company specializing in adding value to real estate properties. The historic Downtown Sacramento building best known in recent years for the former Ambrosia Cafe has a new owner. Records show The Regis Building Group LP bought 1100/1106 11th St. in late January, paying $3.74 million for the four-story, 31,388-square-foot building. The address for the buyer corresponds to real estate investment firm Synergize Ventures, based in the Bay Area.

Dick's Sporting Goods acquires Arden Fair anchor space

The owners of Arden Fair have sold the former Sears anchor space to Dick's Sporting Goods Inc. ahead of the retailer's planned opening of its large-format concept. The mall's ownership purchased the nearly 157,000-square-foot, two-story building on the west end of the shopping center at 1601 Arden Way in 2023 for $7.85 million, which included an adjacent former auto repair center and a parking lot parcel of over 369,000 square feet. The space had been vacant since Sears closed the location in 2021.

Bascom Group acquires West Sacramento's The Strand for $126 million

One of the newest apartment properties in West Sacramento has sold, the second sale of a newer property in recent weeks locally. The Bascom Group LLC, based in Irvine, announced it closed escrow on The Strand, a 408-unit property that opened in 2021 in West Sacramento's Rivers area. Bascom made the deal in partnership with funds managed by Oaktree Capital Management LP.

Trader Joe's buys newly built logistics building from NorthPoint Development for $85 million

A medical office building on the Douglas Boulevard corridor of Roseville has been sold to a medical real estate investment company from Nashville, after Sutter Health recently leased the entire building. Records show Nashville, Tennessee-based Montecito Medical Real Estate bought 2261 Douglas Blvd. in Roseville recently, paying $9.205 million for the 25,000-square-foot building.

Montecito Medical Real Estate buys Sutter Health-leased office building

A medical office building on the Douglas Boulevard corridor of Roseville has been sold to a medical real estate investment company from Nashville, after Sutter Health recently leased the entire building. Records show Nashville, Tennessee-based Montecito Medical Real Estate bought 2261 Douglas Blvd. in Roseville recently, paying $9.205 million for the 25,000-square-foot building.

Benedict Canyon Equities acquires 192 units in Woodland

The multifamily investment company bought the 192-unit Fairmont Apartments, at 575 Matmor Road, for $41 million. Based on the overall price, Benedict paid about $213,500 a unit for Fairmont, which was built in 1986.

Folsom medical office building sold for $7.5 million

A multi-tenant building at 1743 Creekside Drive in Folsom sold for the first time in eight years recently — and at nearly double the previous value. The 20,086-sqaue-foot building sold for nearly $3 million more than its last sale in 2016.

Roseville's Ridge at Creekside Sold to Bay Area-based Group

United Growth, a real estate investment and development company, bought Ridge at Creekside for $39.75 million, making it among the larger retail sales this year in the Sacramento region. Developed in 2002, Ridge at Creekside has about 205,000 square feet of retail space, according to real estate information service Reonomy.

Anchor tenants include REI, Cost Plus World Market and Floor & Decor, the latter backfilling former Bed Bath & Beyond and Buy Buy Baby locations.

EPIC sells office building to Alaskan Indian Tribes

Epic Real Estate Advisors, Inc., one of area’s fastest growing commercial real estate local investment funds and the leading provider of integrated real estate services, today announced that it has sold a commercial office building at 5301 Madison Avenue located in Sacramento, California. The building, which totals approximately 5,500 square foot will be a local home to Alaska’s Tligit & Haida Indian Tribes. “The Tribes have been operating loosely in our region for a few years, but now they have a home for their local members and regional operations.” said Epic’s Heath Charamuga. This location will provide the members of the tribe living in our region with tribal amenities. Epic, who was selling the asset for the local family descendants of Sacramento’s prolific automotive dealer Paul Snider, had generated multiple offers though their disposition process.

Alterra Property Group acquires Rancho Cordova property

Alterra Property Group has executed a sale-leaseback deal for an equipment yard at 3780 Recycle Road in Rancho Cordova, the second such deal it's carried out this year in the region. The 11,200 square foot building siting on a 1.24 acres property sold for $7.35 million. the tenant EquipmentShare, executed a 10-year leaseback.

SlideBelts' El Dorado Hills HQ sold in leaseback deal

Gayatri LLC paid $3.595 million for the 58,316-square-foot building, which sits on 11 acres. That's a gain of more than 71% over what SlideBelts paid for the property in 2022. The latest sale closed in late September. New owner Gayatri LLC is leasing back the space to its current tenant at 5272 Robert J Mathews Parkway, said SlideBelts' Brig Taylor in an email.

Ethan Conrad purchases major office tower for $21 million

Prolific real estate investor Ethan Conrad has confirmed he had the top bid for Downtown Sacramento's Renaissance Tower in an auction completed Wednesday.

Conrad, who's bought two other Downtown buildings in recent months, submitted the $21 million bid that should lead to him formally purchasing the property, he said in an email. He said later Thursday he'd received a formal purchase agreement for the building. The purchase price would be just over a fourth of the sales price the last time Renaissance Tower sold in 2016, for $80 million

.

Hines makes $52 million Sacramento medical office acquisition

Sutter Medical Plaza, a 141,000-square-foot, two-story medical office building, sold for $52 million. The building covers nearly 5 acres in East Sacramento and is fully occupied by Sutter Health. Sutter offers lab, imaging and several pediatric services, including neurology and physical therapy, at the building. For Hines, the acquisition adds to a local portfolio that includes a partial stake in office buildings at 1515 S St. in Sacramento and Natomas Fountains, an apartment project the company is developing in North Natomas.

400 Capital Mall sells to Buzz Oates-affiliated group

Owner Manulife US REIT, an affiliate of a company based in Singapore, will sell 400 Capitol Mall to 400 CM Owner LLC, Manulife. The next owner has the same address at 555 Capitol Mall in Sacramento as Buzz Oates, the commercial real estate investment and development company. According to Manulife's announcement, the 29-story high-rise building will be sold for $117 million. That's a 41% drop from the last sale of the building, also known as Wells Fargo Center, to Manulife in 2019 for $198.75 million.

Two industrial building sell for $9.2 million to Palatine Capital

For the first time since the internet was still new to many people, two industrial buildings on Belvedere Avenue in Sacramento have a new owner.

Miami-based Palatine Capital Partners made what appears to be its first Northern California purchases when it closed escrow in recent weeks on 8440-8460 Belvedere, in Sacramento's Power Inn Road area. The two buildings, about 80,000 square feet combined, are small-bay, multi-tenant structures with high tenant demand. Palatine Capital bought the two buildings for $9.2 million, or about $115 per square foot.

Another industrial sale...EQT Exeter pays $24.3 million for leased asset

A national real estate investment trust's purchase of a fully leased Rancho Cordova industrial building shows some stability returning to that market after interest rate challenges. EQT Exeter, based in Radnor, Pennsylvania, bought 3750 Zinfandel Drive for $24.3 million.

Midtown apartment project sold for 40.175 million to Conam Group

Amid a tight market for new and existing urban residential properties, one in Midtown Sacramento is the first of its kind to sell in the last two years. San Diego-based Conam Group closed escrow late last month on Eviva Midtown, the 118-unit apartment and retail project at N and 16th streets built with modular construction eight years ago. Conam paid $40.175 million for Eviva, or about $13 million less than its last sale in 2017, from the developer to Sequoia Equities and Coit Financial.

770 L Street sells for $22.5 million to Ethan Conrad

Real estate investor Ethan Conrad has made a second investment in Downtown Sacramento, announcing Friday he'd purchased 13-story office building 770 L St.

Conrad said he paid $22.5 million for the 170,000-square-foot building in a short sale. New York Life Insurance Company was the previous owner and

Wells Fargo Bank was the lender. Conrad's description suggests the property was sold for less than its loan amount as a way to avoid potential foreclosure.

Teichert spends $17.99 million on West Sacramento property

A Port of West Sacramento property that recently sold had a rare quality that made it attractive: It was zoned for heavy industrial use. With access to Sacramento Deep Water Ship Channel, 3961 Channel Drive is a 23.55-acre site with one existing building. Teichert closed escrow on it for $17.99 million, under the name Greencycle Properties LLC.

Celebrations acquires Lincoln building for $23.5 million

Industrial developer Buzz Oates has sold a piece of its holdings in Lincoln, after developing it 28 years ago. The buyer, which paid $23.5 million for 1721 Aviation Blvd., will occupy the 150,500 square foot building.

Latino grocery chain buys building on Northgate for $4.5 million

Uriel Barajas and Juvenal Barajas, co-owners of the La Superior Supermercados grocery chain, bought the former store property at 2351 Northgate Blvd. in recent weeks for $4.5 million. Acquiring the closed store at 2351 Northgate may be part of a logical strategy. La Superior's current location in that neighborhood, at 2210 Northgate, is a store of 13,840 square feet with relatively little parking. The new building sits on 3 acres and offers 40,000 square feet of space.

GPR Ventures spends $10 million on industrial building

GPR bought the 23-year-old, 86,702-square-foot building for $10 million. The Campbell-based investment group bought 3735 Cincinnati Ave., a fully leased industrial building just outside Roseville and Rocklin. Current building tenants include A-Tech Flooring, Fuller Moving Services and Quality Chain Corp.

JCPenney property at Roseville Galleria sold for $13.4 million

Copper Property acquired the JCPenney location in Roseville as part of the department store chain's 2020 bankruptcy reorganization. JCPenney continues to operate a store at 1125 Galleria Blvd., a 167,404-square-foot building. The purchase includes 7.7 acres, much of which is parking outside the store building, on the Galleria's east side.

Former corporate office for Nor-Cal Beverage sold to Brennan Investment Group for $36 million

The second-largest privately held industrial property owner in the U.S. has made a move into the Sacramento region by buying several pieces of what was Nor-Cal Beverage Co.'s base in West Sacramento. Brennan Investment Group recently bought three properties: 2150/2286 Stone Blvd. and 1691 Cebrian St. for $36 million

San Diego group pays $15.3 million for Courtyard by Marriott hotel

Built in 1990, the four-story Courtyard at 2101 River Plaza Drive was one of the first hospitality properties to pop up as the South Natomas office market developed in the 1980s and 1990s. Kalthia Group Hotels in San Diego bought the 151-room Courtyard Sacramento Airport Natomas, a Marriott International Inc. (Nasdaq: MAR) brand for $15.3 million.

630 K Street sells to Ethan Conrad

Real estate investor Ethan Conrad has bought a Downtown Sacramento office building near Golden 1 Center, for a future that doesn't involve an office use at all.

Conrad announced Wednesday he'd closed escrow a day earlier on 630 K St., a five-story office building vacant at the moment apart from a few ground-floor and basement retail spaces.

Sacramento medical office building, 80% leased by Sutter Health, sells for $45.55 million

A four-story medical office building at 1201 Alhambra Blvd. sold in late June for more than double what it last sold for 13 years earlier. Toledo, Ohio-based Welltower Inc., a publicly traded real estate investment trust specializing in health care properties, bought the 103,652-square foot building for $45.55 million.

Rancho Cordova industrial park sells for $42.7 million to GPR Ventures

Campbell-based GPR Ventures closed escrow in recent weeks on Capitol Industrial Center North & South, a 335,701-square-foot industrial park in Rancho Cordova. Records show GPR Ventures spent about $42.7 million for Capitol Industrial Center, which has 16 buildings over 23 acres at 9881-9969 Horn Road and 9828-9960 Business Park Drive. The park has 83 suites, with a range of square footages from 1,600 to 22,000.

Epic Real Estate Advisors, Inc. lists Logan's Roadhouse space in Natomas

The Natomas location fills an approximately 7,500-square-foot stand-alone building in the Promenade at Sacramento Gateway shopping center. Last week, Roseville-based real estate brokerage Epic Real Estate Advisors Inc listed the building for sale or lease. The second-generation restaurant building sits on a 1.38-acre parcel that has approximately 78 parking spaces and is near retailers including Best Buy, BevMo and Boot Barn.

Self-storage property sold to investment frim for $19 million

An investment firm formed four years ago with an emphasis on assisting recreational vehicle ownership has expanded in California with a property purchase in West Sacramento. goHomePort, with an address in Chicago, bought a self-storage property for boats and RVs at 3040/3080 Promenade St. and 3555 Ramos Drive in West Sacramento in recent weeks. The 13-acre site, previously known as Southport Self Storage and developed in the early 2000s, sold for $19 million

Epic Real Estate Advisors, Inc sells site at Metro Air Park for new five-story, 99-room hotel project.

Sacramento County has gotten another application for a hotel, this one a five-story Cambria Suites property, though it appears to be part of a group of four.

"The project is proposing 5 story, 99 keys (rooms), approximately 53,960 sq. ft. hotel with full service kitchen and bar including outdoor seating," the project description in the pre-application states. "Building architecture is based on prototype design provided by the franchisor for Cambria Suites Hotel."

Amazon pays $23.603 million for 84 acres in Rancho Cordova

Amazon paid $23.603 million for the property, which is currently undeveloped land. The seller, listed in records as Alta Vista LLC, has the same address as Folsom-based Elliott Homes, the master developer for Rio Del Oro. Amazon appears to be pulling the trigger on a distribution center of more than 600,000 square feet in Rancho Cordova.

Two hotel properties on Howe Avenue sold for affordable housing conversions for $41 million

San Francisco-based The John Stewart Company and Sacramento-based nonprofit Hope Cooperative closed escrow on both the Arden Star hotel at 1413 Howe Ave. the Rodeway Inn at 25 Howe Ave.

Natomas Corporate Center in Sacramento sold to Chavez Management Group

The tallest building in Sacramento's Natomas area, and a neighboring office building that's never had a tenant in its four-year existence, have both sold.

Chavez Management Group Inc., based in Burlingame, bought both 2020 W. El Camino Ave. and 2555 Natomas Park Drive, collectively known as Natomas Corporate Center, in a transaction announced Wednesday. According to Avison Young, Chavez Management paid $44.5 million for the two properties, which sit on 21 acres roughly southeast of where Interstate 5 meets West El Camino Avenue. The larger of the two, 2020 W. El Camino Ave., is a 319,325-square-foot, 20-story building also known as Gateway 2020, built in 2009.

Nearly 1,000 self-storage units in Rocklin sells to New York-based group

According to records, Prime Group paid $20 million for the three-story self-storage property, just west of a Safeway-anchored shopping center.

Total square footage for the units is 98,240, while the building sits on 1.72 acres. Th property has climate-controlled units, electronic access control, drive-up units and a covered loading bay.

City block at 301 Capitol Mall, Sacramento sells for $17 million

The Shingle Springs Band of Miwok Indians bought an entire city block on Sacramento's Capitol Mall, the grassy avenue with landmarks the Tower Bridge and the state Capitol on either end. The tribe bought the land at 301 Capitol Mall for $17 million from the California Public Employees’ Retirement System, which has held the property since 2006, when there was a proposal to develop two 53-story buildings on the site.

FedEx-leased industrial building on Power Inn Road sells for $33 million

Records show 8371 Rovana Circle, a 319,485-square-foot building largely occupied by FedEx Corp. (NYSE: FDX), sold in recent weeks to an entity with a San Francisco address. Records show Lanthian Sacramento LP bought 8371 Rovana Circle for $33 million. That's more than 33% above the 2019 purchase price of $24.5 million, when Blackstone (NYSE: BX) bought that building and 8670 Younger Creek Drive for more than $70 million combined.

Downtown Sacramento office building, nearly fully leased, sold for first time

Escrow closed on 901 H St., a six-story, 51,340-square-foot building built in 1964 that has been under the same ownership until now. The building sold for $5.375 million, or about $1.35 a square foot for the portion of the building that can be leased. Records show the buying entity, Ninth & Jefferson LLC, has the same address in Los Altos as The Hernon Group, a real estate investment company.

Alterra Buys Folsom Construction yard for $6.7 million then leases it back to tenant

A Philadelphia-based commercial real estate investment company made its first purchase in the Sacramento region with a construction yard in Folsom.

Records show 1130 Sibley St. in Folsom sold earlier this month to an entity with the same address as Alterra IOS, a branch of Alterra Property Group that specializes in industrial outdoor storage properties. Alterra bought the 7.03-acre property for $6.7 million, according to property records, in an off-market deal. The property has 19,234 square feet of building space on it.

Howe Avenue Residence Inn hotel proposed for conversion to apartments

Sacramento County has received a pre-application to convert the 176-room property into the same number of apartments, in a project called 1530 Howe Ave. Apartments. Property owner PEG Companies, based in Provo, Utah, didn't return a message seeking comment this week. But when the company bought it in 2018, partner Jameson Haslam said future changes were possible.

New Natomas industrial property owner Eiger Capital could be buying more local assets

Eiger Capital, formed in September 2023, bought 3950 Duckhorn in the North Natomas area for $24.3 million, according to records. The 122,000-square-foot industrial building is fully leased with three tenants: Home Depot, solar power company Sunrun, and logistics company Jillamy Inc.

Six area real estate projects to keep an eye on this year

Economic uncertainty — Recession? Lower interest rates? Elections? — leads to caution in development. That's been the watchword for the last two years, especially when interest rates started rising in 2022. At least at the outset, that's likely to be the conventional wisdom for 2024, too.

North Highlands Super 8 hotel slated for affordable housing conversion

A North Highlands hotel property is headed for an affordable housing conversion, even though it apparently missed out on state money to move it that way.

Called in an application with the county Madison Square Studios, the project would convert an existing Super 8 at 4317 Madison Ave. into 119 units of permanent supportive housing.

Life Time buys Arden Hills property for 12.5 million

The land containing the closed Arden Hills Athletic & Social Club has sold to an entity affiliated with Life Time, which plans to convert it to a new location for the chain and reopen it in 2024. Records show Life Time (NYSE: LTH) bought the 8.87-acre site for $12.5 million.

Local group buys Residence Inn property for $19.6 million

WS Management, a Sacramento-based hotel development and management firm, has bought the 90-room Residence Inn by Marriott in Rancho Cordova, according to property records. PDR Hospitality LP, with an address at the MARRS Building in Midtown Sacramento, bought the Residence Inn Sacramento Rancho Cordova in late December. The address corresponds to WS Management. WS Management paid $19.6 million for the Residence Inn by Marriott, a three-story, 90-room hotel built in 1999. The property is at 2779 Prospect Park Drive.

VSP sells 78,000 sf Rancho Cordova office building for $6.9 million

A local holding company has purchased one of the buildings on eye care giant VSP Vision’s once-sprawling campus in Rancho Cordova. Public records confirm that late last week an entity called JDZ Holdings bought the office building at 3249 Quality Drive for $6.9 million. "We’re pleased with the sale and excited for the JDZ Holdings team to bring in some great new tenants here in Rancho Cordova,” VSP said, in a statement.

Ethan Conrad buys three office properties in Natomas, Rancho Cordova

Conrad, CEO of Ethan Conrad Properties Inc., announced his company closed on the purchases of three new properties last month.

That includes 3215 Prospect Park Drive in Rancho Cordova, a 102,000-square-foot building Conrad bought for $3.96 million; 10961 Sun Center Drive also in Rancho Cordova, which has 44,000 square feet and sold for $2 million; and the 100,000-square-foot 2525 Natomas Park Drive in Sacramento, which sold for $5.35 million.

Predictions...what's coming in 2024 real estate and development

Pandemics, rampant inflation and interest rate hikes tend to throw off prognostication in sizable ways for those parts of the economy. But we're not giving up. Here's what we see coming in the Sacramento region for 2024, with the acknowledgment as always that retired Sacramento Bee business columnist Bob Shallit started this idea and we just stole it.

Argonaut Investment purchases Best Buy-anchored property in Auburn

Retail property investment company Argonaut Investments has entered the Sacramento region with a purchase on Highway 49 in Auburn.

Based in Larkspur, the firm closed escrow last month on The Plaza, a 74,000-square-foot center anchored by a Best Buy. According to records, Argonaut paid $14.5 million for the property, which was built in 2009. Escrow closed on Nov. 20.

.

Two Industrial buildings sell in Rancho Cordova

San Francisco-based Turo Partners closed escrow last week on two neighboring Rancho Cordova buildings on Sanders Drive, between them about 90% leased. About 43,000 square feet combined, the buildings at 11270 and 11280 Sanders Drive sold for $5.5 million.